Tradex Management System

Tradex Management System (TMS) is a flagship product from Tradex Systems.

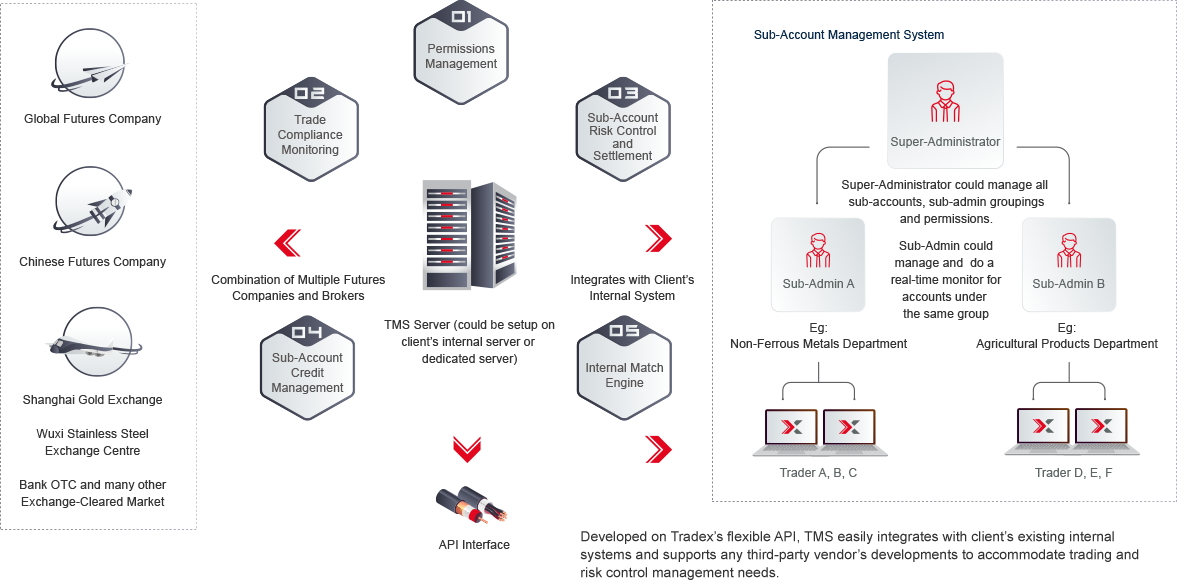

Clients could trade products from multiple exchanges such as Chinese Futures Exchange, Global Futures Exchange, Bank-OTC Market, and Wuxi Stainless Steel Exchange.

TMS provides unified multiple accounts management for your futures trading (collectively manage all global and Chinese Broker accounts), which includes functions such as sub-account management, centralized risk control/monitoring, settlements, positions management, compliance, and internal match.

Tradex’s TMS allows clients to build a unified management platform where you manage global market transactions, manage risk, and do settlement. Tradex’s open API offers unrivalled control and flexibility, and all data are transferred by Straight Through Processing (STP); At the same time, TMS could be integrated to client’s internal ERP system, financial system, and spot management system.

Based on TMS’s unique core advantages and information security, TMS has catered to the top 500 finance companies and industries such as commodity traders, investment banks, and hedge funds companies.

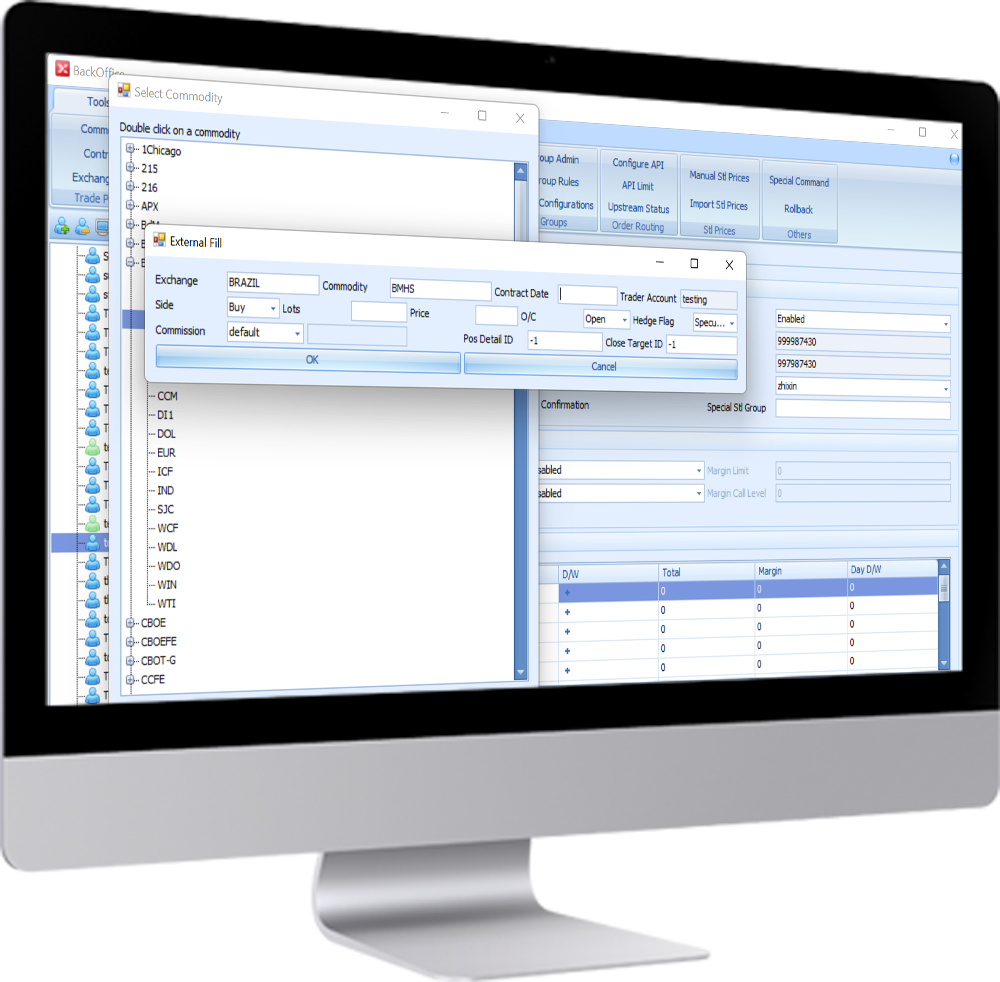

TMS Basic Structure

Global Futures Account Management

Integrates all brokerage accounts to achieve unified management of trading, settlement and account management; Create different types of trading sub-accounts, which includes custom setting of “View” or “Trade” permission.

Open API

Tradex’s Open API integrates with client’s internal systems and any third-party vendor’s developments to accommodate trading and risk control management needs.

Combination of Futures and Settlement Management

Unified management of futures trading positions, separate settlement of sub-accounts, and unified settlement for sub-account groups (group by department, products, brokers); Supports customized settlement billings.

Internal Match Engine

Customizable internal match mechanism that allows internal hedging which reduces commission fees and margin expenses and increases the utilization rate of corporate funds.

Risk Control and Compliance

Compliance to the Exchange rules such as: setting cancel limit, combined position limit, daily open position limit, and self-match prevention; Allowing each account to set different risk indicators that allows clients to manage risk and do real-time monitor all throughout their trading session.

Global Market Coverage

Covers Chinese Futures, Global Futures, Exchange-Cleared OTC Products, Spot Commodity and many more.