Tradex Management

System

MultiTradex

Bank-OTC and

Exchange-Cleared OTC Solutions

Our Products

-

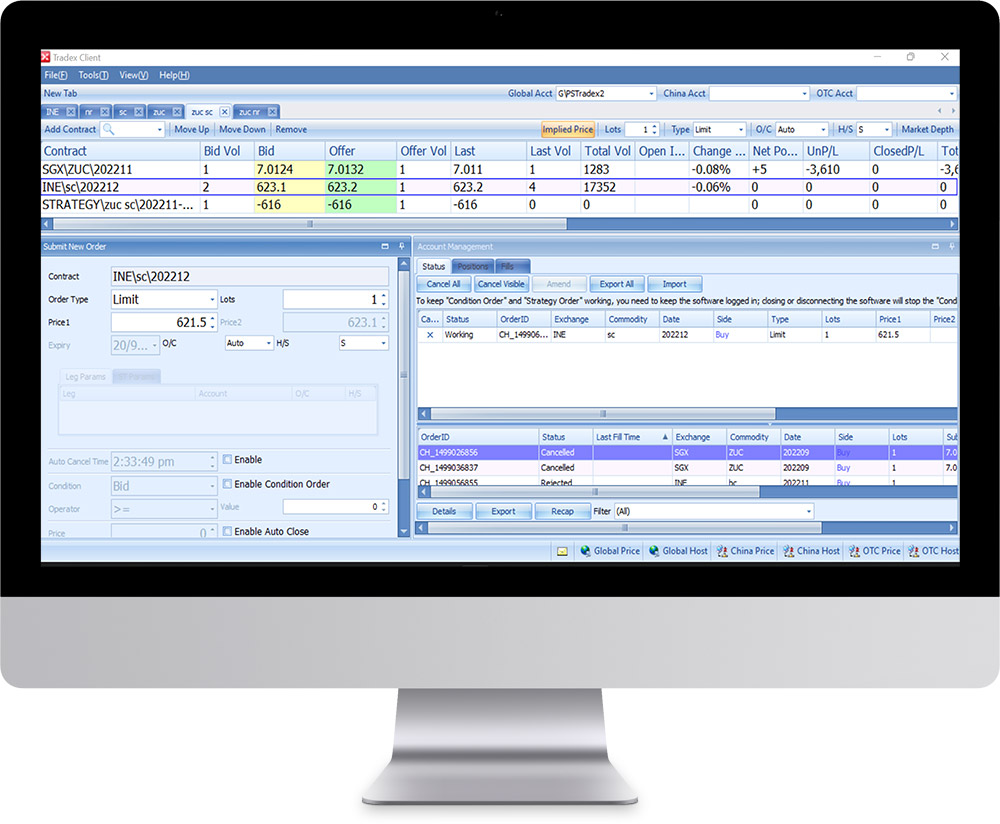

Tradex Management System (TMS)

Tradex Management System (TMS) -

Bank OTC and Exchange-Cleared OTC Solutions

Bank OTC and Exchange-Cleared OTC Solutions -

MultiTradex (MT)

MultiTradex (MT) -

Customized Development Solutions

Customized Development Solutions -

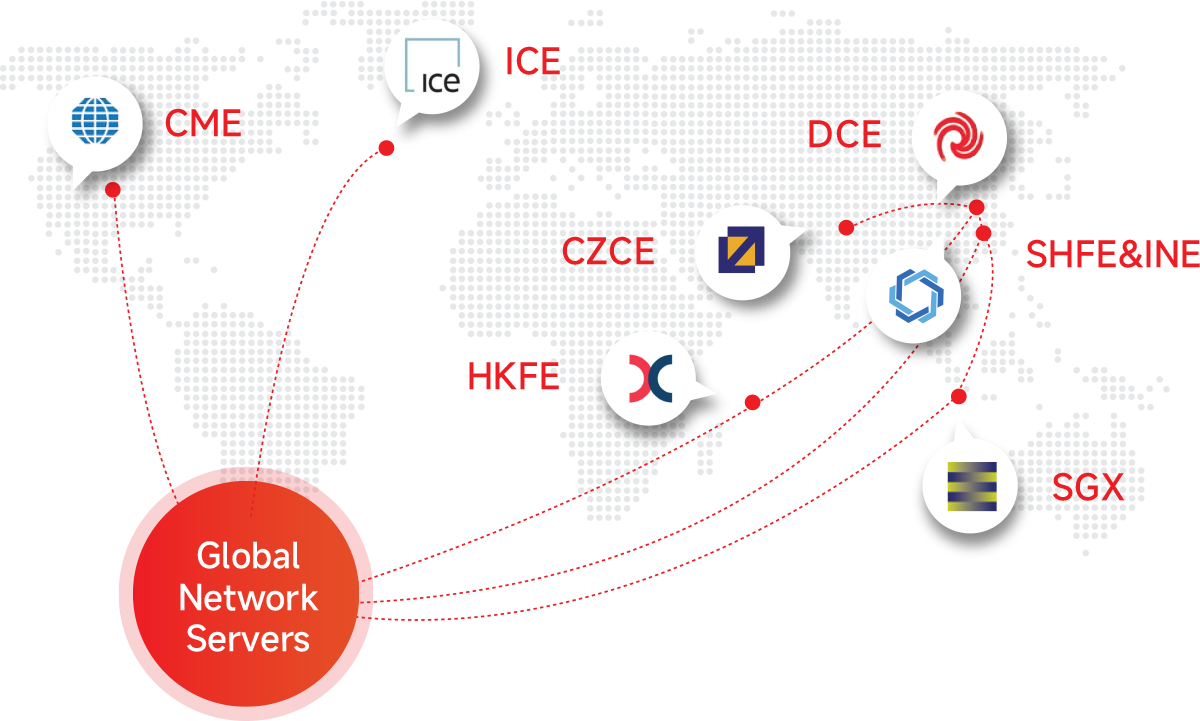

Global Networking Solutions (GNS)

Global Networking Solutions (GNS)

Bank OTC and Exchange-Cleared OTC Solutions

- Access to multiple products such as: Gold Exchange, Wuxi Stainless Steel Exchange and OTC Market

- Supports foreign exchange, non-ferrous metals, precious and other OTC transactions

- Perform OTC and Global Futures arbitrage trading all in one platform

- Customizable OTC Solutions tailored to your trading needs

Global Networking Solutions (GNS)

- Ultra-low latency, robust and secure connectivity to major global market

- Rapid deployment connectivity setup in new region

- Caters to your algorithmic/high frequency trading needs through secure dedicated/shared servers and bandwidth

- Customizable global leased line infrastructure that boosts trading speed

Core Advantages

-

Professional and Dedicated IT Team

Professional and Dedicated IT Team -

Large Industry Clients Base

Large Industry Clients Base -

Leading Technology that Provides Risk Control and Credit Management

Leading Technology that Provides Risk Control and Credit Management -

Arbitrage Trading and Slippage Control

Arbitrage Trading and Slippage Control -

Connects to Global Futures Market and OTC Market

Connects to Global Futures Market and OTC Market

-

Ensure Confidentiality of Information and Strategies Trading

Ensure Confidentiality of Information and Strategies Trading

Professional and Dedicated IT Team

Since 2010, Tradex is committed to solving pain points and coming up with innovations for global futures trading tools. Tradex’s IT team has over 7 years of industry experience and served more than 300 clients to date. Through the constant upgrade of the system, the IT team gained extensive experience in providing customized solutions to meet the trading needs of our clients.

Large Industry Clients Base

Tradex’s products and solutions have catered to multiple top 500 finance companies and industries such as commodity traders, investment banks, brokers (FCM) and more.

Leading Technology that Provides Risk Control and Credit Management

Tradex Management System (TMS) is widely used by more than 30 medium to large enterprise users. Tradex constantly upgrade the system based on client’s needs and changes in the exchange rules, hence providing clients a one-stop trading platform that accommodate their trading needs. Tradex ensures that all products comply to the regulatory requirements both for the Chinese and Global market, such as the penetration test, MIFID II, self-match prevention, position limit, and daily open position limit.

Arbitrage Trading and Slippage Control

Tradex has a strong strategy engine that allows traders to customize multiple-legged strategies. Strategies can be customized to set slippage control and prevent single-legged strategy.

Connects to Global Futures Market and OTC Market

All in one system, Tradex connects to a variety of futures market like global futures, OTC market such as China’s four major futures exchange, global major futures exchange, Shanghai Gold Exchange, and Wuxi stainless steel exchange.

Ensure Confidentiality of Information and Strategies Trading

Through multiple top 500 financial partner’s KYC review, Tradex System ensures confidentiality of client’s trading strategy as it is stored in client’s personal device, and the direct connection of the order execution from trader to the broker further ensure that client’s trading strategies are kept secured.

Pre-Sales Enquiry

Tradex provide you with pre-sales consultation and product demonstration services. Contact our professional team to discuss on trading solutions that caters to your trading needs.

Tradex provide solutions that complies to exchange’s regulations such as a front-end platform for global futures arbitrage trading, risk control and credit management, Bank-OTC, Exchange-Cleared OTC, and Global Networking Solution.

We also provide clients a fully customizable trading solutions, which may include building of new system and functions.

Pre-Sales Advice

Tradex System covers global trading solutions such as arbitrage trading, spread trading, multiple account management, risk control and internal match.

Product Demonstration

If you would like to understand more about Tradex’s solutions for futures trading, our professional consultant could provide you with demonstration through either online or offline means.

Customized Development Solutions Analysis

We work closely with clients to customize trading solutions, design, and testing. Based on their trading needs