Bank OTC and Exchange Cleared OTC Solutions

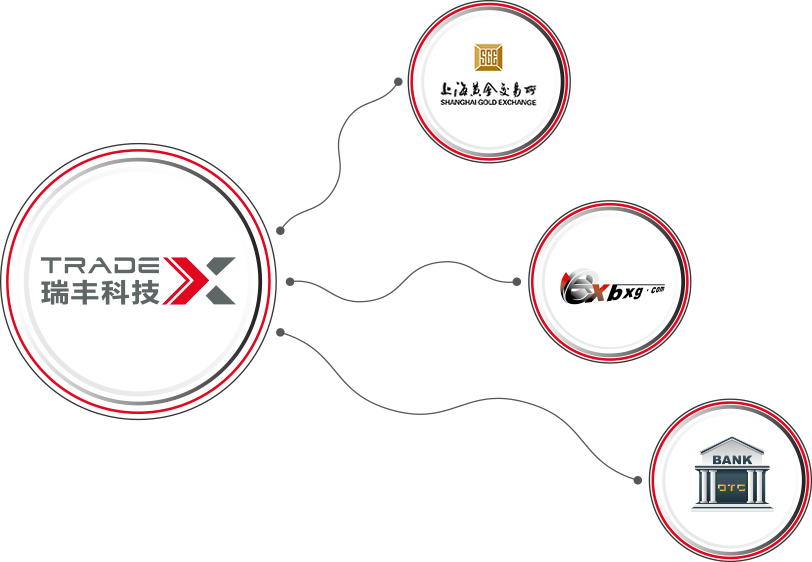

Tradex connects to both global futures and Exchange Cleared OTC, which allows access to exchange such as Bank OTC market, Shanghai Gold Exchange, and Wuxi Stainless Steel Exchange. With Tradex’s strong strategy engine, clients can customize inter-market and inter-commodity spread strategy. Tradex offers customized Exchange-Cleared OTC trading solutions that accommodates your needs.

OTC Services

Self-built internal OTC quote market

We provide customizable futures, swaps, options, and other contracts for both upstream and downstream client transactions, and this is applicable to all types of OTC quotations, achieving real-time hedging with other derivatives markets.

OTC Arbitrage Solutions

Tradex’s trading platform connects both the global futures and Exchange Cleared OTC (such as Shanghai Gold Exchange, Wuxi Stainless Steel Exchange). Through our trading platform, users could use the strategy function to customize inter-market, inter-commodity spread strategy.

Bank-OTC Solution

Users usually need to use different platforms to trade futures, spot, and forward exchange contracts. Trading with different platforms concurrently would mean missing the best price, which is a pain point that enterprises face when developing trading platform. Tradex broke through this pain point by partnering with multiple banks and directly connecting to the bank-OTC price quotation, hence allowing clients to trade both futures and bank-OTC products with one platform.

Combination of futures positions

OTC spot contracts and external fills can imported into Tradex’s TMS, allowing users to have easy access to view the overall trade positions, profit/loss, and to achieve a unified settlement.

With Tradex’s API interface, we offer clients customized development solutions such as access to spot system, futures arbitrage, and many more.