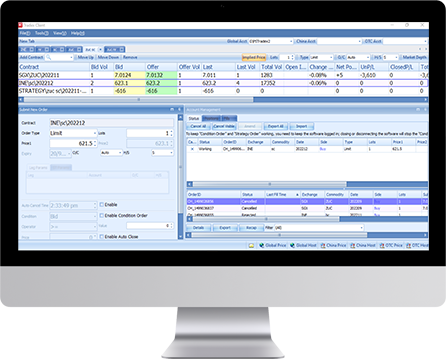

MultiTradex

MultiTradex (MT) is Tradex’s global futures arbitrage trading system. Operating for over 12 years, MT is one of the earliest trading systems that allow simultaneous trading of global futures, Chinese futures, and exchange-cleared OTC products with a highly customizable strategy feature.

Product Advantages

Customized Arbitrage

Support customizable spread strategies such as inter-market, inter-commodity, and inter-exchange spread strategy Strategy’s price formula supports arithmetic operation Strategy could include both the global and Chinese futures, OTC derivatives, and inter-market spread.

Confidentiality of Information

Passed the KYC review of multiple companies with pure technical background Direct connection mode and information does not go through third-party Trading strategies are only saved on local computer and orders are directly sent to the broker

Others

Strategy feature allows unlimited legs, supports complicated arbitrage strategy such as spread/multiple-legged strategy Strategy’s lots multiplier supports decimals or fractions Supports conditional orders such as loop and iceberg orders

Connection to Multiple Markets

Chinese Futures Exchange: SHFE/INE/DCE/CZCE/CFFEX Global Futures Exchange: CME/ICE/SFX/LME/COMEX/APEX… OTC: Bank-OTC/WXSSE/SGE

Strategy Slippage Control

Strategy’s parameters are highly customizable Our well-developed risk dimensions such as tolerance, support multiplier, and active region refines the strategy parameters to impose slippage and reduce the risk of the strategy becoming single-legged.

Open API Interface

Excel data processing functions directly integrated to Tradex’s application Support secondary development, allowing connection to the programmatic trading platform Integrates with enterprises’ internal systems